The Future of Generic Medicine Retail in India

Friday, 5 September 2025 ()

Friday, 5 September 2025 ()

India's pharmacy and healthcare sector has emerged as one of the most dynamic industries in the world, driven by a growing population, increasing healthcare needs, and rising demand for affordable medicines. With a market valued at over Rs. 2 lakh crore in 2024, the pharmaceutical retail sector continues to expand at a compound annual growth rate (CAGR) of around 10-12%. This growth reflects not only rising disposable incomes and urbanization but also the persistent burden of chronic diseases such as diabetes, hypertension, and cardiovascular conditions that require lifelong medication.

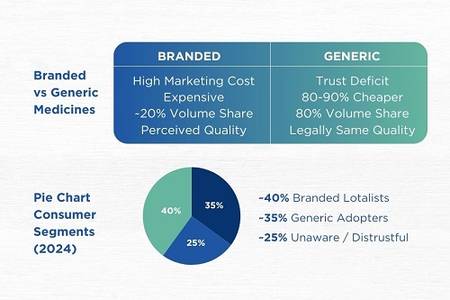

India's pharmacy and healthcare sector has emerged as one of the most dynamic industries in the world, driven by a growing population, increasing healthcare needs, and rising demand for affordable medicines. With a market valued at over Rs. 2 lakh crore in 2024, the pharmaceutical retail sector continues to expand at a compound annual growth rate (CAGR) of around 10-12%. This growth reflects not only rising disposable incomes and urbanization but also the persistent burden of chronic diseases such as diabetes, hypertension, and cardiovascular conditions that require lifelong medication.*Branded dominate perception, generics dominate volume-yet trust and awareness still divide Indian consumers in 2024*A defining characteristic of India's pharmaceutical ecosystem is its dual structure: branded drugs, often priced high due to marketing and distribution costs, and generic equivalents, which are chemically identical but sold at significantly lower prices. Generic medicines account for nearly 80% of the volume of drugs consumed in India, yet consumer preference often leans toward branded medicines due to perceptions of quality and trust.The affordability factor cannot be overstated. For millions of Indian households, monthly medical expenses consume a large share of income. As per government estimates, nearly 65% of out-of-pocket healthcare expenditure in India is on medicines alone. This has made generic medicines central to both healthcare accessibility and affordability. The rising demand for cost-effective treatment options, especially for chronic illnesses, has created fertile ground for organized players and policy-driven initiatives to reshape the sector.*Evolution of Generic Medicine Retail in India*

The divide between branded and generic drugs has long influenced consumer choices in India. While generic drugs are required by law to meet the same quality standards as branded ones, the wide price disparity-sometimes up to 80-90% cheaper-has historically created a perception gap. Patients often equate higher price with better efficacy, while doctors, influenced by pharmaceutical marketing, have tended to prescribe branded medicines.To address affordability challenges, the Government of India has actively promoted generics through initiatives such as the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), which operates Jan Aushadhi Kendras across the country to provide low-cost medicines. Additionally, the National List of Essential Medicines (NLEM) places price caps on critical drugs, while draft pharma policies encourage rational use of generics. These measures have improved access but face operational challenges in scale, consistency of supply, and public trust.The private sector has stepped in to complement these efforts. Companies have established retail chains and digital platforms to improve availability and create awareness. Yet, challenges remain:

· *Awareness Gap* - Many consumers remain unaware that generics are bioequivalent to branded versions.

· *Doctor Prescriptions* - Physicians often continue prescribing branded drugs, limiting patient choice.

· *Trust Deficit *- Concerns around authenticity and quality deter some consumers from switching.

Despite these hurdles, the retail landscape has steadily evolved. Organized players are bridging the trust gap through structured supply chains, pharmacist-led advisory, and patient education.*Rising role of Private Limited Companies*

The rapid evolution of India's generic medicine retail market has been significantly shaped by the entry of organized private companies. These players are addressing long-standing issues of affordability, accessibility, and consumer trust that government initiatives alone have struggled to resolve. By combining structured supply chains, advisory services, and scalable retail models, private limited companies such as* Medkart*, *DavaIndia*, and *Zeelab* Pharmacy have become crucial in transforming how Indians access affordable medicines.*Medkart*

Medkart has adopted an offline-first strategy centered around pharmacist-led advisory. Its stores are designed to educate patients about the bioequivalence of generics and branded drugs, thereby reducing hesitation in switching. By demonstrating cost savings-often up to 60-70% on chronic medications-Medkart has built trust among middle-class and lower-income households. The company began in Gujarat and has been steadily expanding to other states, positioning itself as a reliable alternative to branded medicine retail.*DavaIndia*

DavaIndia, launched by Zota Healthcare, follows a franchise-driven expansion model. With a growing presence across multiple states, it focuses on creating a standardized consumer experience by offering a wide range of generic medicines under one roof. DavaIndia emphasizes bulk savings and competitive pricing, attracting not just individual patients but also small clinics and healthcare providers. By offering thousands of SKUs (stock keeping units), it has positioned itself as a large-scale player in the affordable medicines space.*Zeelab Pharmacy*

Zeelab Pharmacy takes a slightly different approach by emphasizing direct-to-consumer supply chains and integrating teleconsultation support into its retail operations. The company markets itself as a tech-enabled, customer-centric brand, aiming to improve affordability through both physical stores and online platforms. Zeelab also places strong emphasis on chronic care patients, offering subscription models to ensure continuity of affordable treatment.*Comparative Landscape*

When compared:

· *Jan Aushadhi (Government) *provides affordability but struggles with supply consistency and brand building.

· *Private limited companies (Medkart, DavaIndia, Zeelab)* bring scale, structured advisory, and customer trust, while maintaining competitive pricing.

· *Digital-first platforms (1mg, PharmEasy, NetMeds)* focus on convenience and reach but often emphasize branded discounts alongside generics.

Together, these private players have created an ecosystem where patients are empowered with choice, transparency, and affordability. Their collective presence signals a shift toward organized, professionalized retail that can complement government schemes while filling critical gaps in awareness and accessibility.*Current market dynamics & consumer behavior*

Indian consumers are gradually shifting from brand loyalty to cost savings, especially in urban middle-class households where healthcare expenses are significant. The COVID-19 pandemic further accelerated awareness of generics as patients sought affordable alternatives during supply disruptions.However, gaps remain. Many patients remain skeptical, viewing generics as "inferior" despite regulatory assurances. This skepticism often stems from limited communication by healthcare providers and resistance from the branded pharma lobby, which has vested interests in maintaining premium drug sales.*Key market drivers include:*

· *Digital Health Adoption* - Online pharmacies and e-consultations encourage price comparisons.

· *Chronic Illness Burden* - Growing prevalence of diabetes, hypertension, and cancer necessitates long-term affordability.

· *Insurance Penetration* - Though limited, insurance coverage expansion influences prescribing and purchasing trends.*Barriers persist as well:*

· *Regulatory Scrutiny* - Quality monitoring by NPPA and CDSCO must keep pace with scale.

· *Counterfeit Concerns* - Ensuring authenticity is critical for consumer trust.

· *Lobby Pushback *- Branded pharma continues to resist large-scale substitution of generics.The result is a market in transition: while affordability drives adoption, awareness and trust will ultimately determine the pace of generic retail growth.*What experts say*

Health economists often highlight generics as central to reducing India's out-of-pocket healthcare burden. *Dr. Ramesh Chand*, a health policy researcher, notes, "Generic substitution can reduce medicine bills by up to 70%. With chronic illnesses on the rise, this is not just an economic issue but a public health imperative."Doctors are increasingly open to prescribing generics, though hesitancy remains. *Dr. Anjali Mehta*, a general physician, observes: "Patients often ask if a lower-cost drug is as effective. When explained that generics meet the same standards, they accept. The challenge is building that initial trust."Pharma policy experts caution that without robust monitoring, rapid expansion could expose risks. A CDSCO official recently emphasized the need for "stringent post-marketing surveillance and stronger supply chain audits" to prevent counterfeit or substandard medicines from undermining confidence.Companies like Medkart, by offering pharmacist-led support, could influence prescription behavior indirectly. As patients increasingly demand affordable options, doctors may adapt prescribing practices, while regulators may strengthen frameworks like NLEM price controls and mandatory generic prescriptions.*What is the future of Generic Medicines in Retail India*

The outlook for generic medicine retail in India is one of rapid expansion and consolidation. Over the next 5-10 years, the market is expected to grow at double-digit rates, driven by affordability needs, supportive government policies, and the scaling of organized retail chains.Future models are likely to be hybrid-combining offline advisory with online convenience. Technology will play a central role, from digital prescriptions to AI-driven substitution suggestions. Regional players such as Medkart are poised to expand nationally, while large digital platforms may diversify into offline presence.Ultimately, the affordability challenge will define the future. As branded pharma faces pressure from both policy and consumer demand, generics will become mainstream. Companies that combine trust, advisory, and scale will shape the future of healthcare access in India.

|

||||

|

|

||||

You Might Like |

||||